St Albert Property Tax

The municipal residential property tax rate is set at 00025. 2021 Residential Tax Rates.

4045 Overbrook Lane Houston Tx 77027 Like The Glass Tile In The Shower Free Standing Victoria Albert Bath Tub Double Shower Master Bathroom Bath

Property Tax in Alberta.

St albert property tax. AND WHEREAS the assessed value of all taxable property in the City of St. Property tax rates to be levied against assessable property within the City of St. You can request a change of mailing address by submitting a Change of Address form.

0292 2019 Residential Farmland Non-Residential Municipal Tax Rate 80226 110141 Education - Alberta School Foundation Fund Tax Rate 25735 34319 Allowance For Non-Collection of Requisitioned Taxes 0 0 The city has also temporarily eliminated transit ridership. Botanica Condos For Sale - St. Albert real estate below.

Taxable Assessment esidential Farm LandR 10504362340. It is based on the assessed value of a property. NOW THEREFORE the City of St.

Albert Place 5 St. The City of St. Albert as shown on the 2020 assessment roll is.

Your property tax is made up of three components including the municipal levy the education levy and the seniors levy. In 2019 for every residential property tax dollar 5818 pays for municipal services 4032 is collected on behalf of Alberta Education and 15 supports. If council decides to halt the tax migration as MacKay has proposed the 25-per-cent tax increase would break down to approximately 17 per cent for non-residential properties and 27 per cent for residential properties St.

I have yet to read one election brochure that addresses the over-taxation of homeowners. Albert for the 2021 taxation year. Albert Property Tax Rates expressed in mills Municipal Code.

City of St. The total value of a municipalitys property taxes and grants in place. Albert AB T8N 3Z9.

On Monday city councillors voted for a zero-per-cent tax increase for businesses. To 5 pm Monday through Friday. 74 18 per cent Municipal utilities provided.

Seniors need help on St. Albert resident with a home assessed at 450000 would be 414 per month. Read more about Botanica condo listings.

Anne Street view map St. Albert strives to provide accurate and equitable assessments that are used for collecting taxes. Alberts director of assessment.

In 2019 for every residential property tax dollar 5818 pays for municipal services 4032 is collected on behalf of Alberta Education and 15 supports the seniors housing as operated by Homeland Housing in the towns within Sturgeon County and the City of St. Alberts property tax rate of 105199 per cent means those owning homes with an assessed value of 250000 will pay 2630 annually and 5260 on a home assessed at 500000. The amount households in St.

To open a web customer account contact the City of St. The 2021 tax rates that were approved by City Council on May 17 2021 Bylaw 272021 are shown below. After business hours on weekends or during holidays you can drop off your payment through the mail slot located on the right-hand side of the front doors at St.

Water sewage storm sewers garbage recycling. Albert City Council just doesnt get it and neither do the wannabes. View the hottest Botanica condos for sale St.

Property TaxesProperty tax is a tax based on the assessed value of a property. Albert Taxation Branch St. On March 23 council passed a bylaw cancelling late tax penalties for April 1 and July 1.

NNo -Residential 1960431570 Total 12464793910. Albert pay per month for property tax varies. Address Block Lot Owners Last Name - Deed Date Sale Price Acreage Absentee Taxes Year Built and more.

Albert - Total Property Taxes. A property is valued at 30000 which when calculated 30000 x 00025 equals a tax bill of 75. Since this amount is less than the minimum tax of 100 the property owner would receive a tax notice of 100 owing.

Albert the property tax rate is 105199 per cent which means that residents with homes at a value of 250000 pay 2630 annually and homes with a value of 500000 have a property tax. Oct 16 2013 1200 AM By. Albert needs to raise 110 million from property taxes this year in order to cover its expenses which meant a 25-per-cent increase councillors heard last week.

While the City of St Albert provides the information contained within the following maps and screens in good faith it does not warrant covenant or guarantee the completeness and accuracy of this information. It is used to pay for city services such as police the fire department and public transit as well as elementary and secondary education. Search NJ Tax Assessment Records - Search by.

They also reduced the planned average. If you own a property you will have to pay property tax. The Assessment Department calculates the assessment according to provincial legislation and guidelines.

Property tax is a tax on land and property. Contact your financial institution to find out more about making your payments on-line or through telephone banking. The City of Wetaskiwin offers a monthly payment plan to pay your property taxes throughout the year.

You can now view property assessments trace levy and legal property descriptions as well as locate these properties on a map by. For example property taxes for a St. Albert Taxation Department at 780-459-1516.

Property Tax Rates Profile Created on 11132020 10418PM City of St. Albert Senior Homeowners Property Tax Assistance Grant program eligible seniors receive a 200 flat. Albert in Council assembled enacts as follows.

Please note that pop-up blocking software must be disabled to use this service. However two councillors filed motions to pare that back. For additional information including sales history and prices property disclosures and more for Botanica properties for sale or to schedule a condo tour contact your local real estate experts today.

Our business hours are from 8 am. Albert Senior Homeowners Property Tax Assistance Grant Program The purpose of the grant is to reduce the impact of increases in municipal property taxation for eligible senior. Albert AB T8N 3Z9 Phone.

Always Fill Out A Unit Condition Form Upon Arrival And Departure And Be Sure You Have The Landlord Being A Landlord Rental Property Management Rental Property

How To Buy A Small Multifamily Property A Step By Step Case Study For Newbies Investment Property For Sale Rental Property Investment Investing

Merry Christmas To All And To All A Happy New Year Sending Special Wishes For The Christmas Holiday From My St Albert Merry Christmas To All Love Your Life

Pin On Homes For Sale In Edmonton Alberta

Atlantic Canada Property Tax Rates Calculator Wowa Ca

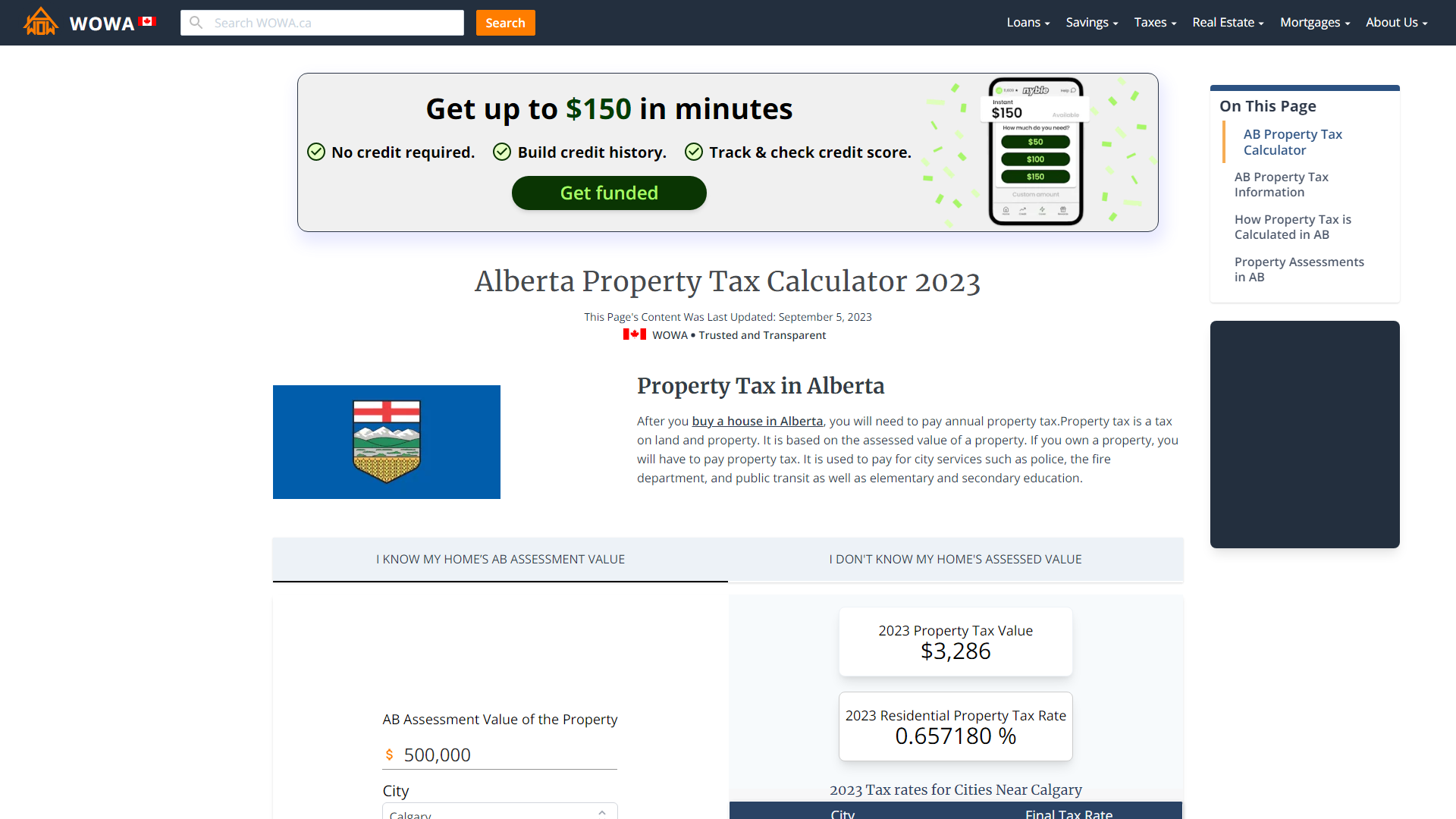

Alberta Property Tax Rates Calculator Wowa Ca

Har Com 3769 Garnet Houston Tx 77005 Dream Bathrooms Bathroom Interior Design Bathroom Interior

Landscape Interactive Map City Of St Albert

Chad Oppenheim Ayla Golf Club Szukaj W Google Architectural Photographers Architecture Beautiful Buildings

Current Tax Rates City Of St Albert

Printable Residential Inspection Report Template Word In 2021 Being A Landlord Rental Property Management Rental Property

E Tax Depreciation Schedules Is A Fancy Freshen For A Document That Tells Your Accountant How Much Depreciation To Sworn Investing Told You So Schedule Service

Xmas Tree Christmas Embroidery Patterns Embroidery Patterns Vintage Christmas Embroidery

10042 Larston St Houston Tx 77055 Har Com Property For Sale Property House Styles

Landscape Interactive Map City Of St Albert

Payment Information City Of St Albert

Personal Injury Lawyer Law Firms In Toronto Singer Kwinter Personal Injury Lawyer Injury Lawyer Personal Injury

Mapquest Maps Driving Directions Map Map Driving Directions Irvington

Post a Comment for "St Albert Property Tax"