Dripping Springs Property Tax Rate

NO HOA required for this Sunset Canyon lot. In 2021 that value increased to 415407 an increase of 37769 or 10.

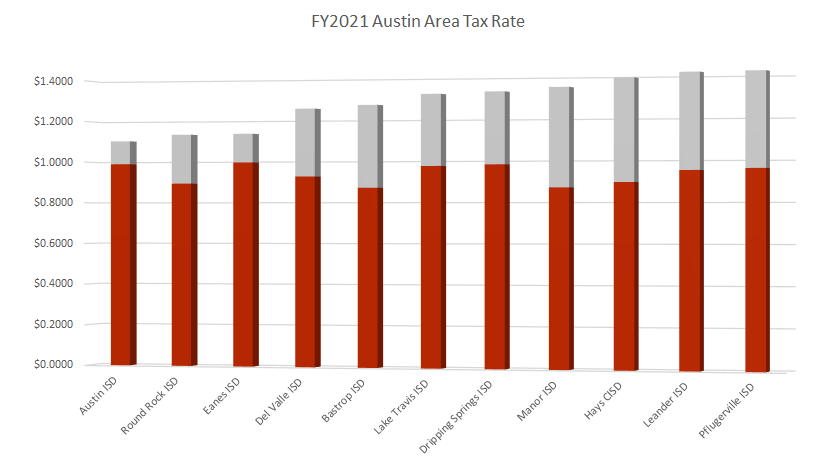

Interactive Compare Approved Tax Rates Across The Austin Area For Fiscal Year 2017 18 Community Impact

Home appreciation the last 10 years has been 1275.

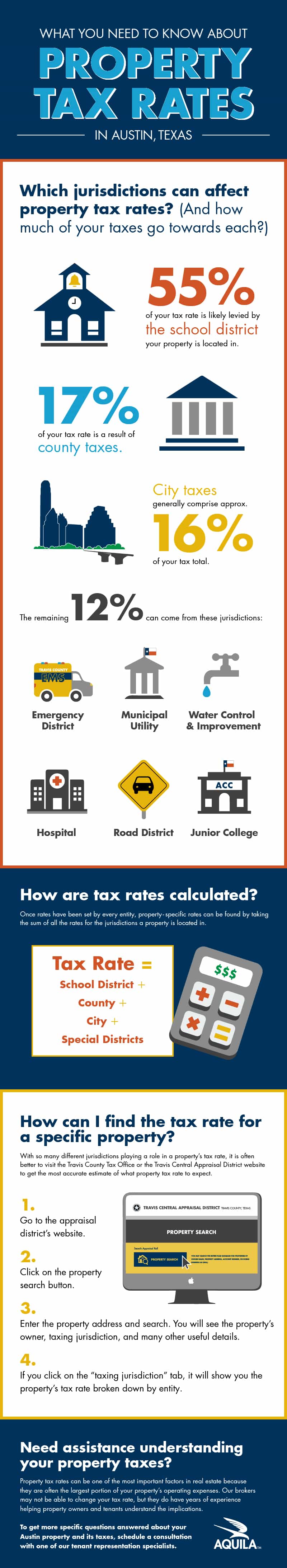

Dripping springs property tax rate. The 86th Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state. Austin school districts property tax rates. In 2020 the total tax levy was 1521115 while in 2021 it increases to 1853806 an increase of 332691 or 2187.

Dripping Springs ISD trustees voted to set its 2021-22 tax rate at 13103 per 100 valuation on Sept. 27 slightly lower than last years rate of 13332 per 100 valuation. DRIPPING SPRINGS The city of Dripping Springs proposes to keep the property tax rate set at 019 per 100 valuation.

Dripping Springs ISD had a total tax rate of 152 from 2014-15 to 2018-19. View photos map tax nearby homes for sale home values school info. While keeping the tax rate the same as the last two fiscal years the city could see boosted revenue through the completion of.

01900 per 100 NO-NEW REVENUE TAX RATE. 27 slightly lower than last years rate of 13332 per 100 valuation. 2018 Tax Rates Exemptions.

2015 total taxable value. The December 2020 total local sales tax rate was also 8250. This is the total of state county and city sales tax rates.

Following a discussion of expected budget expenses the Court proposed a slightly lower property tax rate of 4690 cents per 100 in assessed property value. The following table compares the taxes imposed on the average residence homestead by North Hays County ESD No. 1 last year to the taxes proposed to be imposed on the average residence homestead by North Hays County ESD.

The average taxable value of a homestead within the city of Dripping Springs in 2020 was 377638. The current statewide sales tax rate in Texas is 625. 2020 Tax Rates Exemptions.

However localities can levy additional taxes resulting in a higher rate in some areas. The average homeowner will see increases in their tax bills due to rapidly rising property values which was a concern discussed at the meeting. The Texas sales tax rate is currently The Dripping Springs sales.

Dripping Springs currently holds a rate of 825. Compare the best Property Tax lawyers near Dripping Springs TX today. 2016 Effective Tax Rate Worksheet City of Dripping Springs Date.

City of Dripping Springs Fiscal Year 2020-21 Budget Cover Page This budget will raise more total property taxes than last years budget by 150772 which is a 1157 percent increase and of that a1nount 162451 is tax revenue to be raised from new property added to the tax roll this year. The median home cost in Dripping Springs is 695900. In 2019-20 following legislative action House Bill 3 passed in the 86th session DSISDs adopted rate dropped to 142 10684 MO35 IS per 100 of certified property values.

The city of Dripping Springs has proposed to maintain its property tax rate for fiscal year 2021-22 at 019 per 100 valuation the same rate set in FY 2019-20 and FY 2020-21. Updated Home in Sunset Canyon in Dripping Springs Tx on 234 Acres - no HOA and low tax rate. Dripping Springs Texas Sales Tax Rate 2021 The minimum combined 2021 sales tax rate for Dripping Springs Texas is.

09252019 1148 AM 1. Use our free directory to instantly connect with verified Property Tax attorneys. The table below provides 2017 property tax rates for.

2017 Tax Rate Calculation Worksheet Date. 2016 Tax Rates Exemptions. Dripping Springs City Council Recorded Roll Call Vote.

2017 Tax Rates Exemptions. 212 Wynnpage Dr is a 4 Beds property in Dripping Springs TX 78620. The Median Texas property tax is 227500 with exact property tax rates varying by location and county.

The current tax rate is 4691 cents and would have remained the same under the Judges proposed budget. 2014 Tax Rates Exemptions. Dripping Springs ISD trustees voted to set its 2021-22 tax rate at 13103 per 100 valuation on Sept.

Housing in Dripping Springs Texas. A tax rate of 01900 per 100 valuation has been proposed by the governing body of the City of Dripping Springs Texas. Beautifully updated stone and wood 2-story home in Dripping Springs.

09252019 1147 AM Taxing Units Other Than School Districts or Water Districts City of Dripping Springs Taxing Unit Name Phone area code and number Taxing Units Address City State Zip Taxing Units Website Address. Enter the amount of 2015 taxable value on the 2015 tax roll. Inicio Sin categoría headwaters dripping springs tax rate.

2019 Tax Rates Exemptions. The current total local sales tax rate in Dripping Springs TX is 8250. 2015 Tax Rates Exemptions.

Headwaters dripping springs tax rate.

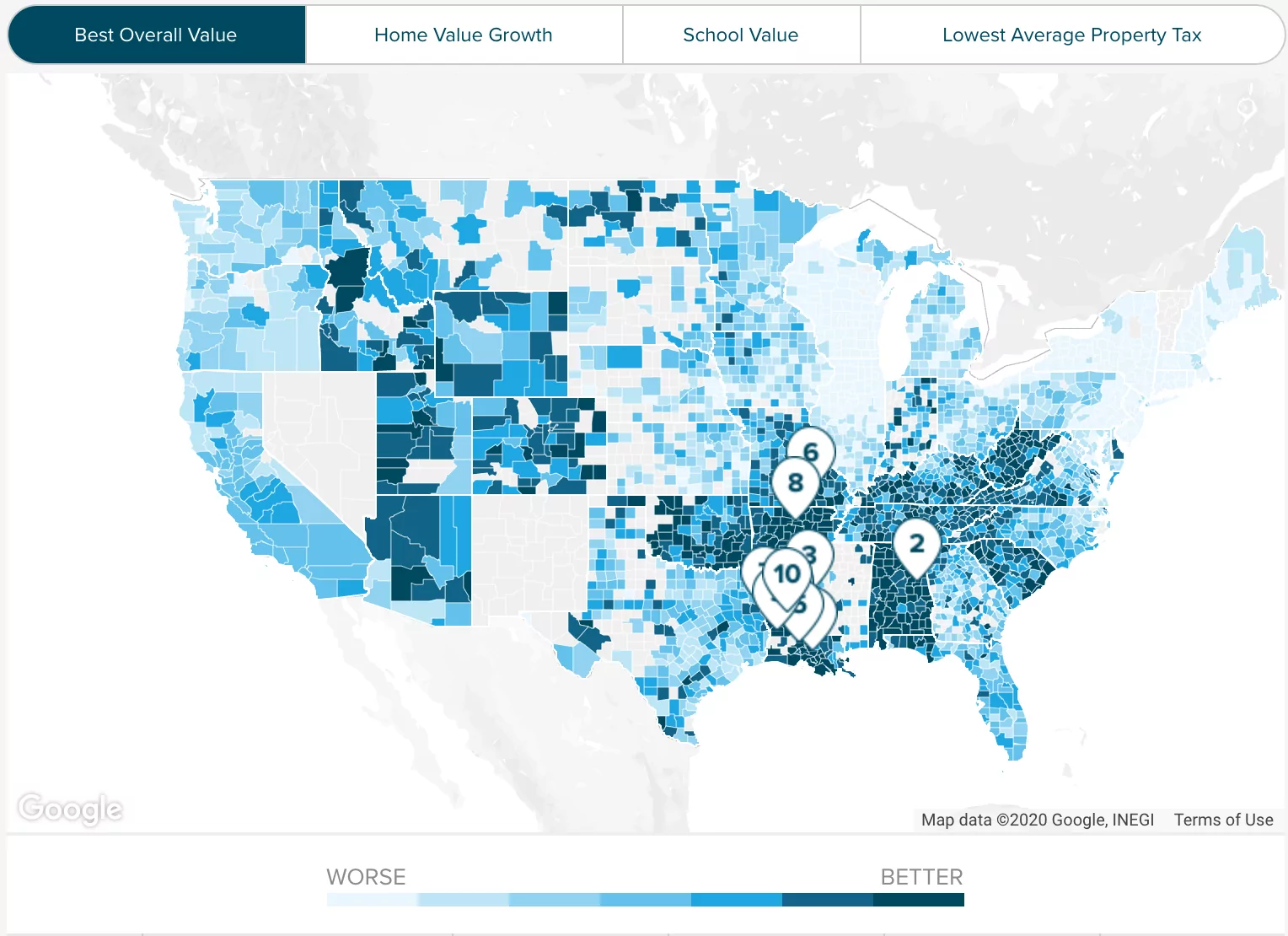

Local Leaders At Odds With Texas Legislative Focus On Slowing Property Tax Growth Community Impact

Helpful Phone Numbers Hays County Wimberley Texas Pedernales Dripping Springs Texas

Dripping Springs Property Tax Rate To Stay The Same

Commercial Property Tax Rates In Austin Texas

Harris County Tx Property Tax Calculator Smartasset

Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact

Hutto Officials Adopt 0 536448 Tax Rate Creating Little To No Change For Property Taxes Community Impact

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Data How Much Is Austin S Median Homeowner Paying In Property Taxes Community Impact

Board Agenda Includes Adoption Of Decreased Tax Rate

Dsisd Board Approves 2020 21 Tax Rate With Decrease Of 8 5 Cents

Austin Property Tax Rates H David Ballinger

Dripping Springs Plans To Make No Change To Property Tax Rate Community Impact

Commercial Property Tax Rates In Austin Texas

Commercial Property Tax Rates In Austin Texas

Property Tax Protests On The Rise As Home Values Increase Community Impact

Post a Comment for "Dripping Springs Property Tax Rate"