Cabarrus County Tax Bill

Interest Fees Taxes. Property tax bill balances are due January 5th or next business day of the calendar year following the tax bill year.

Cabarrus County Board Of Commissioners Regular Meeting November

If you have any questions about the data displayed on this website please contact the Cabarrus County Assessors Office at 704 920-2126.

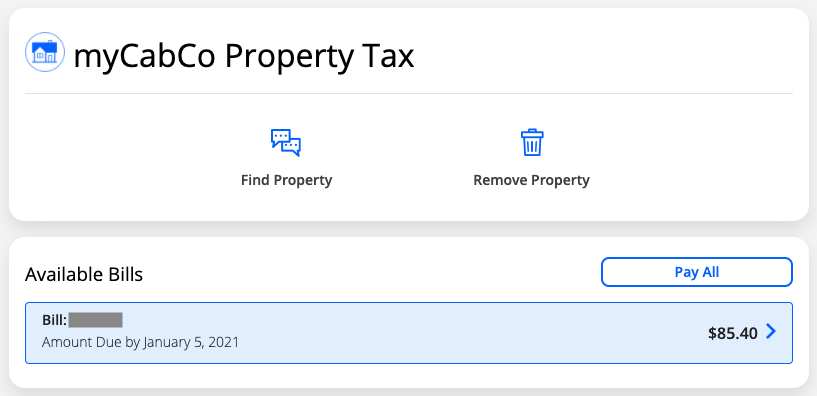

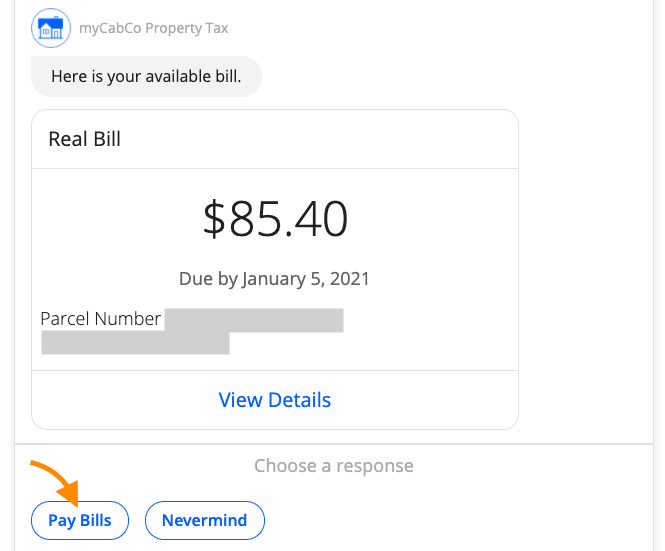

Cabarrus county tax bill. Sign in to your Profile on myCabCo see Create a myCabCo Profile 2. Paying a Property Tax Bill Payment Methods Pay a Cabarrus County Property Tax Bill Pay Multiple Tax Bills at One Time Partial Payments on myCabCo Scheduling Payments on myCabCo Why are some bills missing from my Property Account. Collects annual tax bills for County and our municipalities.

If paid after Jan. Assesses real estate values in Cabarrus County. For technical problems related to this website please contact the Cabarrus County ITS Help Desk at 704 920-2154.

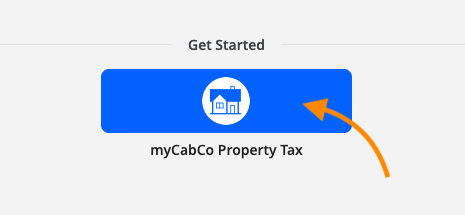

This years tax bills maintain the ad valorem tax rate of 74 cents per 100 of property value. Via the myCabCo website myCabCocabarruscountyus or app using a credit or debit card. Visit myCabCo Get the app Download the official app of Cabarrus County North Carolina myCabCo to pay your property taxes schedule payments access receipts and more.

Cabarrus County real estate and personal property tax can be paid in the following ways. Concord residents receive one tax bill for both City of Concord and Cabarrus County property taxes. 5 2022 property owners are subject to interest charges.

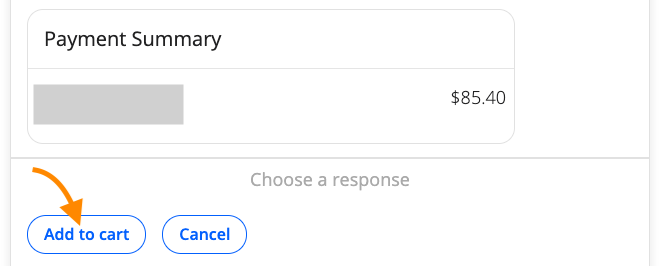

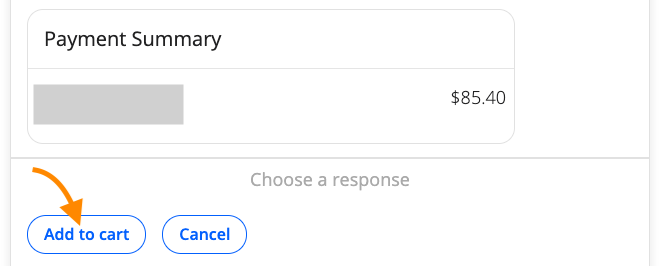

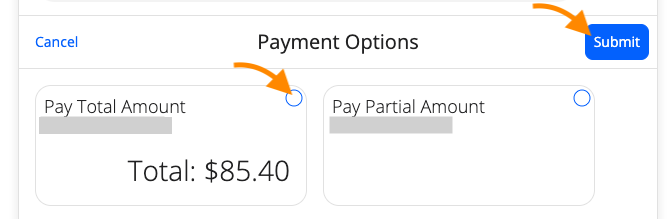

Pay a Cabarrus County Property Tax Bill. Check Pay Partial Amount and click Submit. Assesses value on personal property business personal property and motor vehicles.

It is the responsibility of the taxpayer to contact the collections office to request the payment plan option upon receipt of their annual tax bill. Enter the amount that you would like to pay and click on Submit. This years tax bills maintain the ad valorem tax rate of 74 cents per 100 of property value.

The Countys single-bill initiative already implemented in Harrisburg Kannapolis Locust Mt. Details of bills both paid and duedelinquent can be viewed and printed from this system. The all in one app that provides citizens instant access to a multitude of government services through its modern secure solution utilizing a single login payment methods receipts and official documents.

Cabarrus County real estate and personal property tax bills are due on September 1. Contact Collections at 704-920-2119. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

July 25 2019. Cabarrus County Real Estate and personal property Tax can be paid in the following ways. If you have any questions about the data displayed on this website please contact the Cabarrus County Assessors Office at 704 920-2126.

For owners of a 210000 house the median single-family assessed home value in Cabarrus that equates to 1554 a year in County property tax. Contact the Revaluation department at 704-920-2126. For technical problems related to this website please contact the Cabarrus County ITS Help Desk at 704 920-2154.

Make a tax bill inquiry. This years tax bills maintain the ad valorem tax rate of 74 cents per 100 of property value. For owners of a 210000 house the median single-family assessed home value in Cabarrus that equates to 1554 a year in County property tax.

Pay a Cabarrus County Property Tax Bill. If youre ready to pay your property taxes or schedule a payment continue to myCabCo. Choose the bill you wish to pay.

To pay a Cabarrus County Property Tax bill online. Contact the Assessors department at 704-920-2166. Cabarrus County real estate and personal property tax can be paid in the following ways.

Sign in to your Profile on myCabCo see Create a myCabCo Profile 2. Partial payments are applied to the bill in the following order. For owners of a 210000 house the median single-family assessed home value in Cabarrus that.

Property tax bills are due on September 1 and are classified as past due if not paid before January 7 2020. The minimum payment is 150. Collects annual tax bills for County and our municipalities.

Follow the steps to Pay a Cabarrus County Property Tax Bill and select the bill s to be paid. Payments to Cabarrus County should be made payable to Cabarrus County Tax Collections and mailed to PO Box 707 Concord NC 28026-0707. Download the myCabCo app Today.

Via MyCabCo website or app using credit or debit card by mail using envelope and coupon provided with bills in drop box at the County Government Center. Pleasant and Midland is a cost-saving measure that streamlines the billing process and minimizes. Pay your taxes online.

Residents also have the option of viewing their property tax bills online at wwwcabarruscountyustax. Cabarrus County Tax Administration has four divisions including. Maintains property maps and ownership information and assists with tax relief applications.

In-depth Cabarrus County NC Property Tax Information. Find forms explore requirements for tax listings. Via the myCabCo website myCabCocabarruscountyus or app using a credit or debit card.

Property tax bill balances are due January 5th or next business day of the calendar year following the tax bill year. Tax Listing Forms and Requirements. View the Latest News from Cabarrus County.

For owners of a 210000 house the median single-family assessed home value in Cabarrus that. Cabarrus County real estate and personal property tax bills will mail to residents on July 26. Bills are due Sept.

Contact Collections at 704-920-2119. The complete Tax Rate list is available. Download myCabCo an official app of Cabarrus County North Carolina.

Contact Land Records at 704-920-2127. It is the responsibility of the taxpayer to contact the collections office to request the payment plan option upon receipt of their annual tax bill. To pay a Cabarrus County Property Tax bill online.

This years tax bills maintain the ad valorem tax rate of 74 cents per 100 of property value.

.png?ver=keqdjwDuuWc-kjRPtMKBfg%3D%3D)

City Of Concord Nc Services Community News

/cloudfront-us-east-1.images.arcpublishing.com/gray/22LGLH43PRGWPONXTBRRC4N6UI.jpg)

Cabarrus County Gets Revaluation Notices In The Mail

Pay A Cabarrus County Property Tax Bill Mycabco

Financial Literacy Habitat For Humanity Cabarrus County Debt To Income Ratio Money Saving Tips Budgeting Money

Pay A Cabarrus County Property Tax Bill Mycabco

Pay A Cabarrus County Property Tax Bill Mycabco

Job Opportunities Cabarrus County Jobs

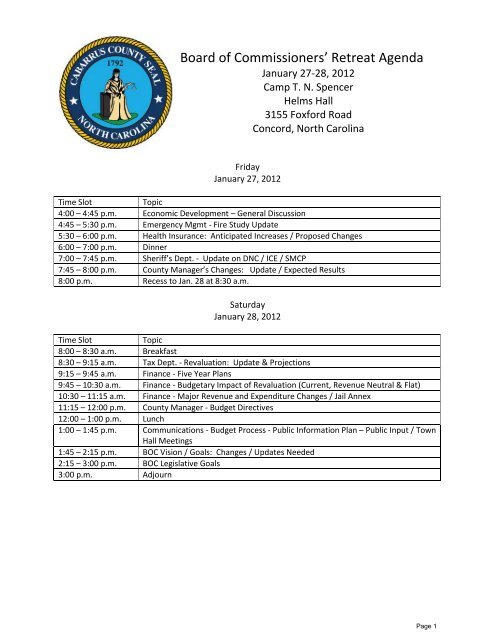

Retreat Agenda And Information Cabarrus County

Pay A Cabarrus County Property Tax Bill Mycabco

Real Estate And Personal Property Tax Bills Due January 6 Latest Headlines Independenttribune Com

My 2017 Writing Plan Of Action Music Composition Novels Writing Life

Pay A Cabarrus County Property Tax Bill Mycabco

Cabarrus County Board Of Commissioners Regular Meeting November

Silver Alert Issued For Missing Endangered Cabarrus County Man Possibly With Dementia

Cabarrus Property Tax Bills Hitting Mailboxes Soon Local News Independenttribune Com

Post a Comment for "Cabarrus County Tax Bill"