Does Increasing Credit Limit Hurt Score

Does increasing your credit limit hurt your credit score. Keep balances below 30 for best results.

6 Benefits Of Increasing Your Credit Limit

However similar to when you apply for a new credit account a hard inquiry might hurt your scores.

Does increasing credit limit hurt score. How Does an Increased Credit Limit Help Your Credit Score. A credit line increase reduces your credit utilization ratio which usually helps improve your credit scores. Posted by 3 years ago.

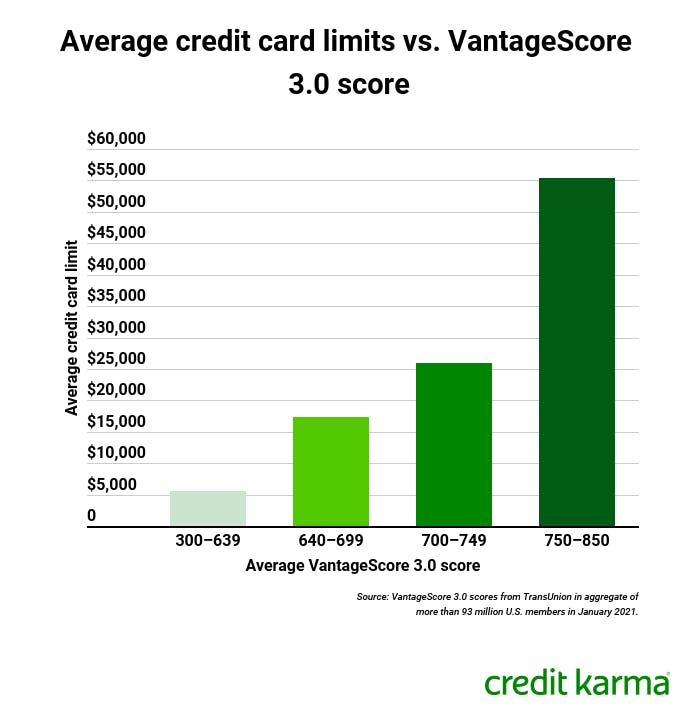

A credit score is an important metric lenders use to determine a borrowers ability to repay. Lowering your credit limit can actually hurt your credit scores. So for example if your credit limit was 2000 and you have a balance of 1000 you are utilizing half or 50 of that credit line.

Does getting a credit limit increase affect score. Does increasing your credit limit with a hard pull of your credit scorehistory hurt or help your credit more. Whether a limit increase affects your credit is determined by whether the credit card company does a soft no effect or hard small effect pull when you request the increase.

When a lender lowers your limit or closes your credit card account that may raise your credit utilization rate. Why Your Credit Limit Matters. But the health of your credit depends on the way you manage your account.

How Balances and Credit Limits Affect Credit Scores As long as you dont also increase your credit card balances an increase in your credit limits should reduce your utilization rate or balance-to-limit ratio. Getting a credit limit increase will not hurt your score. Your credit limit can affect your credit scores depending on how much of your available credit you use.

Whether it does depends on if the card issuer reviews your credit report with a hard or soft inquiry before making their decision. However increasing your credit limits on your credit cards will not likely hurt and can help your credit scores in the long run. Your credit score is based on the information found on your credit report.

A credit limit increase will most likely help your credit score assuming you dont go on a spending spree with it. Youre not alone in thinking that a credit limit increase can hurt your score and make it harder to get a mortgage. My credit score is good in the high 700s and Im looking to buy a house in a year so I want to make sure this wont hurt me too much.

How Asking for a Credit Limit Increase Works. Waiting for your lender or bank to automatically increase your credit limit could be the best option as it avoids making a request that might negatively impact your credit score. If its a soft inquiry your credit scores wont be affected at all.

Each lender determines a credit limit when you open an account but it may reassess your limit later based on various factors. Requesting a credit increase can have a few results. In fact it may actually raise it because it will lower your debt-to-credit ratio.

If you become unemployed or require credit urgently you may find it challenging to get approved. A common myth is that increasing your credit limit will damage your credit score. Increasing your credit limit can lower credit utilization potentially boosting your credit score.

Your debt ratio is factored by weighing the amount of money you have already borrowed against the amount of money it is possible for you to borrow. When a lender raises your credit card limit that may lower your credit utilization rate and in some cases could increase your score. Although it can help your credit score by lowering your credit utilization it can also lower your credit score if there will be a so-called hard inquiry into your credit history.

Yes increasing your credit limit can hurt your credit score because a hard inquiry is usually placed on your credit report causing a slight drop in your credit score. In fact merely asking for a credit limit increase might affect your score even if the card issuer denies your request. However if your request is approved your credit score may improve in the long run.

In theory increasing your credit limit should have an overall positive effect on your credit score. In otherwords your credit limit vs. Having a higher credit limit can give you more options when it comes to making larger purchases and expanding your credit history.

Getting declined for a credit limit increase might impact your credit scores. The reason is that doing so increases your overall balance to limit ratio or utilization rate. If a lender decides to reduce the credit limit on one of your accounts your credit utilization ratio may spike which can negatively impact your credit scores.

Credit can be a useful and essential part of the modern financial world and your credit limit can be an important factor in demonstrating how responsible you are with credit. When any details on your credit report changesuch as your credit card limitit can have an impact on your credit score. Increasing your credit limit could actually boost your credit score.

Utilization has no memory so yes your score will rebound immediately after your cards are paid off. A credit limit increase can be a double-edged sword. Years ago the common wisdom was that the more credit you had available the riskier the borrower.

A credit limit increase can help improve your credit score. Spending more than 30 of your available credit can affect your score even if you pay off your balance every month. Get a credit limit increase before you need one.

The answer is that it depends but its worth asking. It doesnt matter to your FICO score who closed your account -. Your credit utilization could lower which in turn could help boost your score.

Im looking to increase my credit limit since its only at 1000. But this isnt strictly true. Be sure not to undo.

Be Careful When Closing Your Credit Cards Credit Card Help Credit Repair Credit Repair Companies

How To Increase A Credit Score In Order To Get The Best Rates On Mortgages And Other Loans Http Www Slidesh Credit Score No Credit Loans Fico Credit Score

When Should I Ask For A Credit Limit Increase Nerdwallet

Credit Cards Funny Kreditkarte Lustig Kreditkarte Creditcard Creditcards Creditcards Credit Cards Fu Paying Off Credit Cards Budgeting Money Credit Card

Pin On Best Of Savvy Personal Finance

Why You Should Think Twice Before Accepting A Credit Limit Increase

Want To Improve Your Credit Score Improve Your Credit Score Improve Credit Score Improve Credit

What Is A Credit Limit And How Is It Determined Credit Karma

Jenns Blah Blah Blog Nm Mom S Tips Tricks Hack Recipes Credit Repair Companies Credit Repair Letters Credit Repair

Consequences Of Going Your Credit Limit Credit Com

Get Your Free Credit Report From Crif High Mark Know Your Personal Credit Score Before You Apply For Credit To Save Your Credit Score Scores New Credit Cards

What Credit Limit Will I Get When I Apply For A Credit Card

Knowing Your Credit Score And How To Improve It Improve Credit Score Credit Score Improve Your Credit Score

Will Lowering My Credit Card Limit Hurt My Credit Score Improve Credit Score Improve Credit Credit Repair Services

Does Opening A New Credit Card Affect Your Credit Score Modmoney Credit Card Design Paying Off Credit Cards Credit Score

Does Changing Your Credit Limit Hurt Your Credit Score

When Should I Ask For A Credit Limit Increase Nerdwallet

Post a Comment for "Does Increasing Credit Limit Hurt Score"