How Much Is Tax In Oklahoma

This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Cities andor municipalities of Oklahoma are allowed to collect their own rate that can get up to 51 in city sales tax.

That S 29 467 A Year Before Taxes And Insurance Are Deducted Teacher Working Two Jobs 10 Picture

If the purchased price falls within 20 of the Blue Book value then the purchase price will be used.

How much is tax in oklahoma. Oklahoma Sales Tax. The state general sales tax rate of Oklahoma is 45. The Oklahoma OK state sales tax rate is currently 45.

After a few seconds you will be provided with a full breakdown of the tax you are paying. The median annual property tax paid by homeowners in Oklahoma is just 1278 one of the lowest amounts in the US. Cities andor municipalities of Oklahoma are allowed to collect their own rate that can get up to 55 in.

The state general sales tax rate of Oklahoma is 45. How much is tax per dollar in oklahoma. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

The bonus tax calculator is state-by-state compliant. Improving Lives Through Smart Tax Policy. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

For vehicles that are being rented or leased see see taxation of leases and rentals. Every 2021 combined rates mentioned above are the results of Oklahoma state rate 45 the county rate 0 to 3 the Oklahoma cities rate 0 to 51. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN.

To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Tax amount varies by county.

This Oklahoma bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Oklahoma LNG Tax. If the purchase price is too low or high then the Blue Book value will be used.

Depending on local municipalities the total tax rate can be as high as 115. The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name. People Also Asked How much is oklahoma tax.

Property taxes in Oklahoma are relatively low as the state has an average effective property tax of 087. With local taxes the total sales. Find your Oklahoma combined state and local tax rate.

2000 on the 1st 150000 of value 325 of the remainder. Withholding taxes are based on the most current Federal and State withholding rates. Thats why we came up with this handy Oklahoma.

Registration fees depend on how long you have been the owner of your vehicle and will go down per year every 4 years. Depending on local municipalities the total tax rate can be as high as 115. Learn about Oklahoma tax rates rankings and more.

Please forward any questions suggestions problems and complaints about this application to. The Oklahoma OK state sales tax rate is currently 45. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle.

The median property tax in Oklahoma is 79600 per year for a home worth the median value of 10770000. Explore data on Oklahomas income tax sales tax gas tax property tax and business taxes. The state sales tax is 45 cents per dollar.

Alone that would be the 14th-lowest rate in the country. States that tax groceries rate if not fully. Oklahoma sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Oklahoma Tax Rates Rankings Oklahoma State Taxes Tax Foundation. 325 of the purchase price or taxable value if different Used Vehicle. Standard vehicle excise tax is assessed as follows.

Please consult your tax adviser for tax advice or more technical questions about how tax laws apply to you. You may ask How much is Oklahoma food tax. Also know How is sales tax calculated in oklahoma.

New vs Used Vehicle Tax in Oklahoma City The tax rate of a vehicle in Oklahoma City is determined depending on the type of vehicle. 31 rows The state sales tax rate in Oklahoma is 4500. Cities and counties tack on as much as six and a half cents more.

New vehicle tax will run shoppers 325 of the purchase price while used vehicle are 20 up to a value of 1500 in. Overview of Oklahoma Taxes. 1 Oklahomans will pay anywhere from 5 cents to 11 cents on the dollar in sales or use taxes depending on the city and county they live in.

However in addition to that rate Oklahoma has some of the highest local sales taxes in the country with combined city and county rates as high as 7. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states.

How long do you have to pay tag title and tax in Oklahoma. Counties in Oklahoma collect an average of 074 of a propertys assesed fair market value as property tax per year. In Oklahoma LNG is subject to a state excise tax of 05 per gallon effective January 1 2014.

The Oklahoma bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The state sales tax rate in Oklahoma is 450.

Oklahoma Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

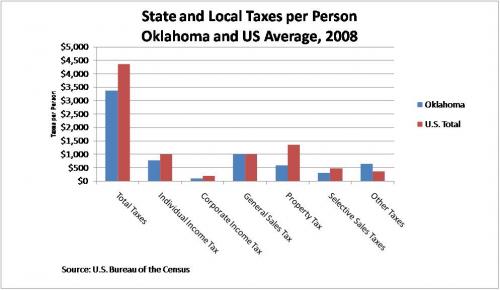

How Oklahoma Taxes Compare Oklahoma Policy Institute

Cannabis Tops Alcohol In Oklahoma In 2020 Southwest Ledger

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Local Tax Information City Of Enid Oklahoma

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma Paycheck Calculator Smartasset

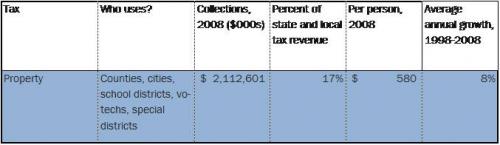

Property Tax Oklahoma Policy Institute

Big Cabin Ok Giant Indian Chief Standing Brave Big Cabin Roadside Attractions Oklahoma Travel

Idaho Retirement Tax Friendliness Retirement Calculator Financial Property Tax

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

Gamblers Love To Use Casino Win Loss Statements Because It Is Easy Just Report The Amounts From The Casino Win Loss Statements No Mus Casino Slot Tournaments

All About Okc The Fifth Issue Of Velocity An Interactive Magazine That Showcases Dynamic Stories Of Oklahoma City S Rise Recently Launc Okc City City Pride

Learn About Oklahoma Tax Rates H R Block

Irs Announces 11 7 Million Exclusion For 2021 Estate Tax Money Market Estate Planning

We Are Extending Our Hours For Tax Free Weekend Sale Starting August 5th 7th We Will Be Open Friday And Saturd Tax Free Weekend Oklahoma Boutique Weekend Sale

Post a Comment for "How Much Is Tax In Oklahoma"