Williamson County Tax Rate

The Williamson County sales tax rate is. 3 the countys total taxable property value rose to 767 billiona 16 increase from 2020.

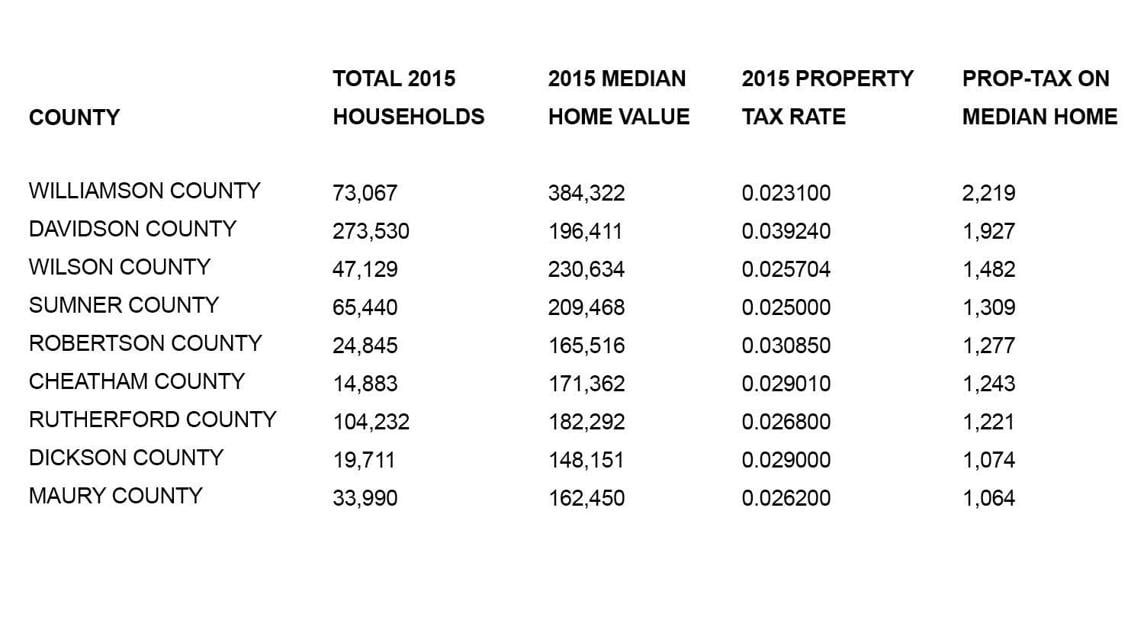

The Tennessee Counties With The Lowest Property Tax Rates

Williamson County Property Assessor.

Williamson county tax rate. Contrary to popular belief the Property Assessor does not set the tax rate does not send out tax. The 2018 United States Supreme Court decision in South Dakota v. If approved by the full commission this new property tax rate would apply to every 100 of assessed value.

State legislation adopted in 2019 SB 2 makes a number of changes to local governments property tax rate setting process. Local Tax Rate Change in Williamson County On February 6 2018 voters in Williamson County voted to increase the local sales tax rate to 275. The County Commissioners Court has no control over the taxable value of property.

Tax Roll Information and Open Records. This table shows the total sales tax rates for all cities and towns in. Puerto Rico has a 105 sales tax and Williamson County collects an additional 1 so the minimum sales tax rate in Williamson County is 725 not including any city or special district taxes.

Williamson County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Williamson County Tax Code Listing 2019 2020 J530 J530 J530 J530 J530 U005 J530 PKHN J530 J530 MOSQ J530 J521 J530 J530 J530 Total Rate Prior Rate Ä001 AOOI Ä001 VLAW Ä001 AOOI A001 J530 VLHN AOOI PKHN Ä001 FDWC AOOI Ä001 A001 VLAW AOOI VLÄW Description 530 4 CT99 U004 CT99 U004 CT99 U005 CT99 U004 CT99 U004 CT99 VLÄW CT99 U004. Vehicle Inventory Tax VIT Public Improvement Districts PIDs Manufactured Homes.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Williamson County has one of the highest median property taxes in the United States and is ranked 78th of the 3143 counties. We are not responsible for the setting of tax rates or determining property values.

The median property tax in Williamson County Texas is 3817 per year for a home worth the median value of 172200. The total sales tax rate in any given location can be broken down into state county city and special district rates. Contrary to popular belief the Property Assessor does not set the tax rate does not send out tax.

The effective date of the tax rate increase is April 1 2018. Williamson County approves 650M budget 188 property tax rate. 2016 Williamson TN.

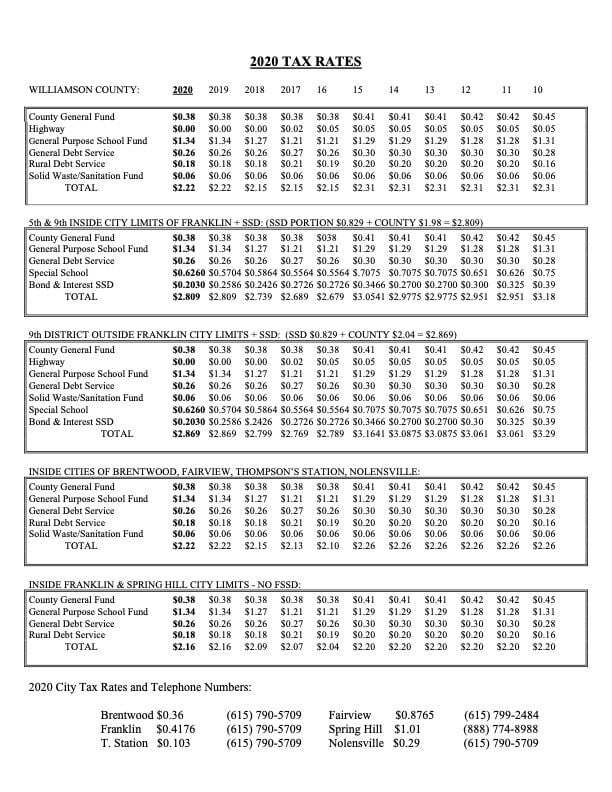

Williamson County collects on average 222 of a propertys assessed fair market value as property tax. Tax rates for Williamson County and each city or town within Williamson County are set each year by their respective legislative bodies County Commission and governing bodies based on the budgets they pass to fund programs and services. The vendor fees associated with credit card transactions and e-checks are passed along to the credit card or e-check users and are not paid by the Williamson County budget.

Tennessee has a 7 sales tax and Williamson County collects an additional 275 so the minimum sales tax rate in Williamson County is 975 not including any city or special district taxes. This table shows the total sales tax rates for all cities and towns in. In a daylong voting meeting the.

It only has control over the annual property tax rate that is levied. Tax rates for Williamson County and each city or town within Williamson County are set each year by their respective legislative bodies County Commission and governing bodies based on the budgets they pass to fund programs and services. The Texas state sales tax rate is currently.

Contact Us Office. You can find information about tax rates for jurisdictions throughout the County here. 2020 Taxing Rates and Exemptions by Jurisdiction.

2021 City Taxes Collected by the City - See Contact Telephone City of Brentwood 02900 City of Fairview 08765 615 799-2484 City of Franklin 03261 City of Spring Hill 07928 888 774-8988 Town of Nolensville 02900 Town of Thompsons Station 01030. The Williamson County Appraisal District annually assesses the taxable value of all property in Williamson County. Delinquent Tax Penalty and Interest Charts.

The county commission passed Williamson Countys 2021-2022 budget of over 650 million on Monday. Search Property. Tax Code Listing District Rate Listing The tax computation report contains a wealth of property tax information for each taxing district.

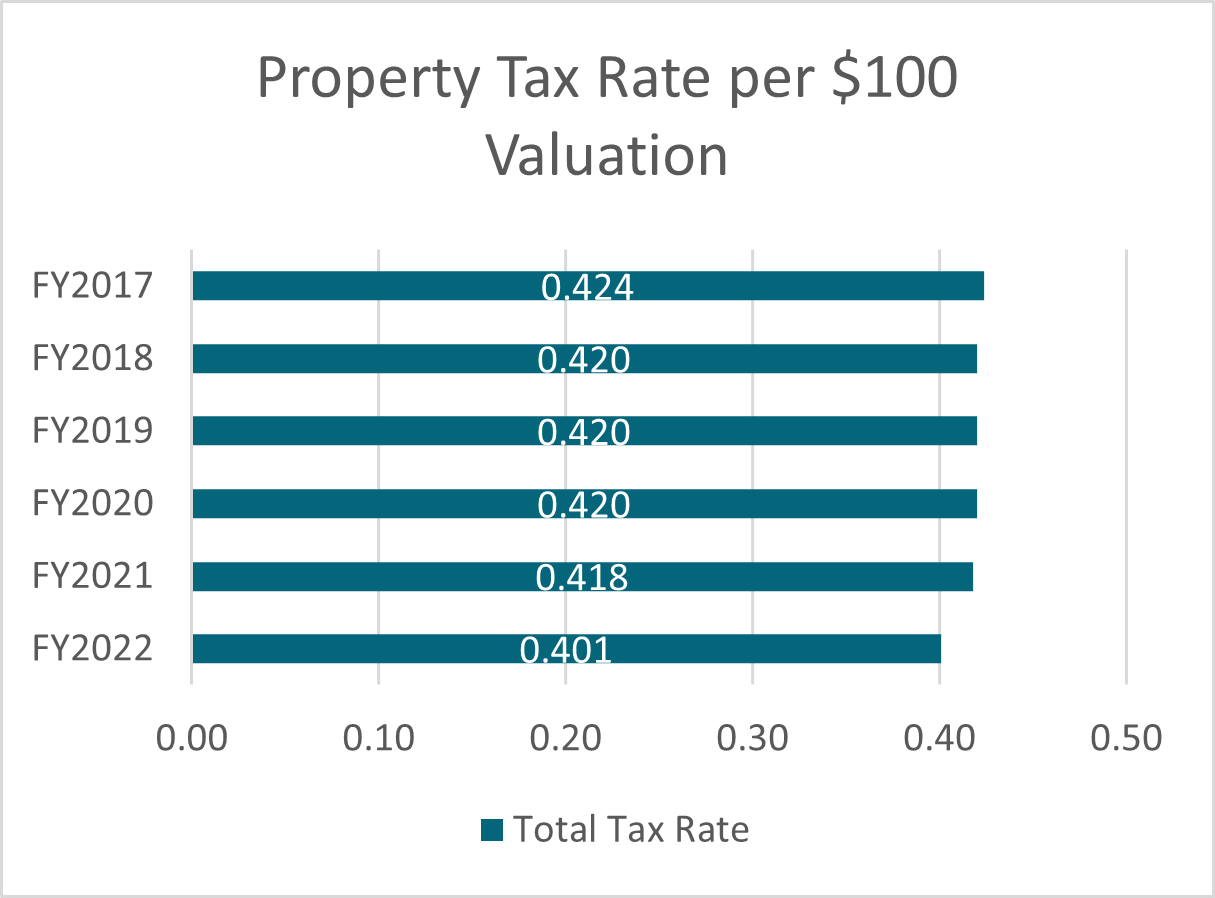

Over 65-Disabled Person-Disabled Veteran-Tax Deferral. The fiscal 2021 property tax rate was maintained at 04187 TAV well below the constitutional rate cap of 80. Pictured is Williamson Countys property tax rate history through 2020.

Larry Gaddes the tax assessor-collector for Williamson County told commissioners Aug. 2021 City Tax Rates Collected by Williamson County Trustee. Application of the New Tax Rate The new rate will apply to all taxable sales of.

Issuing of tax certificatesGeorgetown office only and there is a 10 fee for each certificate cash or check only Please note that the Williamson County Tax Collector only collects property tax for the County and other jurisdictions. 2021 Taxing Unit Contact List. The median property tax also known as real estate tax in Williamson County is 381700 per year based on a median home value of 17220000 and a median effective property tax rate of 222 of property value.

TAX RATE INFORMATION Your taxes owed can be calculated as follows. When using the online property tax payment option there is a 150 fee for all e-checks and a 215 fee for all credit card transactions. This includes the equalized assessed valuation EAV of each type of property within the district the amount.

Indeed the proposed tax rate is 13 cents higher at 188. Williamson Countys fiscal 2020 ad valorem tax rate used for operations was 04187 per 100 of TAV. 15 rows Williamson County Texas has a maximum sales tax rate of 825 and an approximate population.

The minimum combined 2021 sales tax rate for Williamson County Texas is. Property tax amount tax rate x taxable value of property 100. This is the total of state and county sales tax rates.

Responsibility.

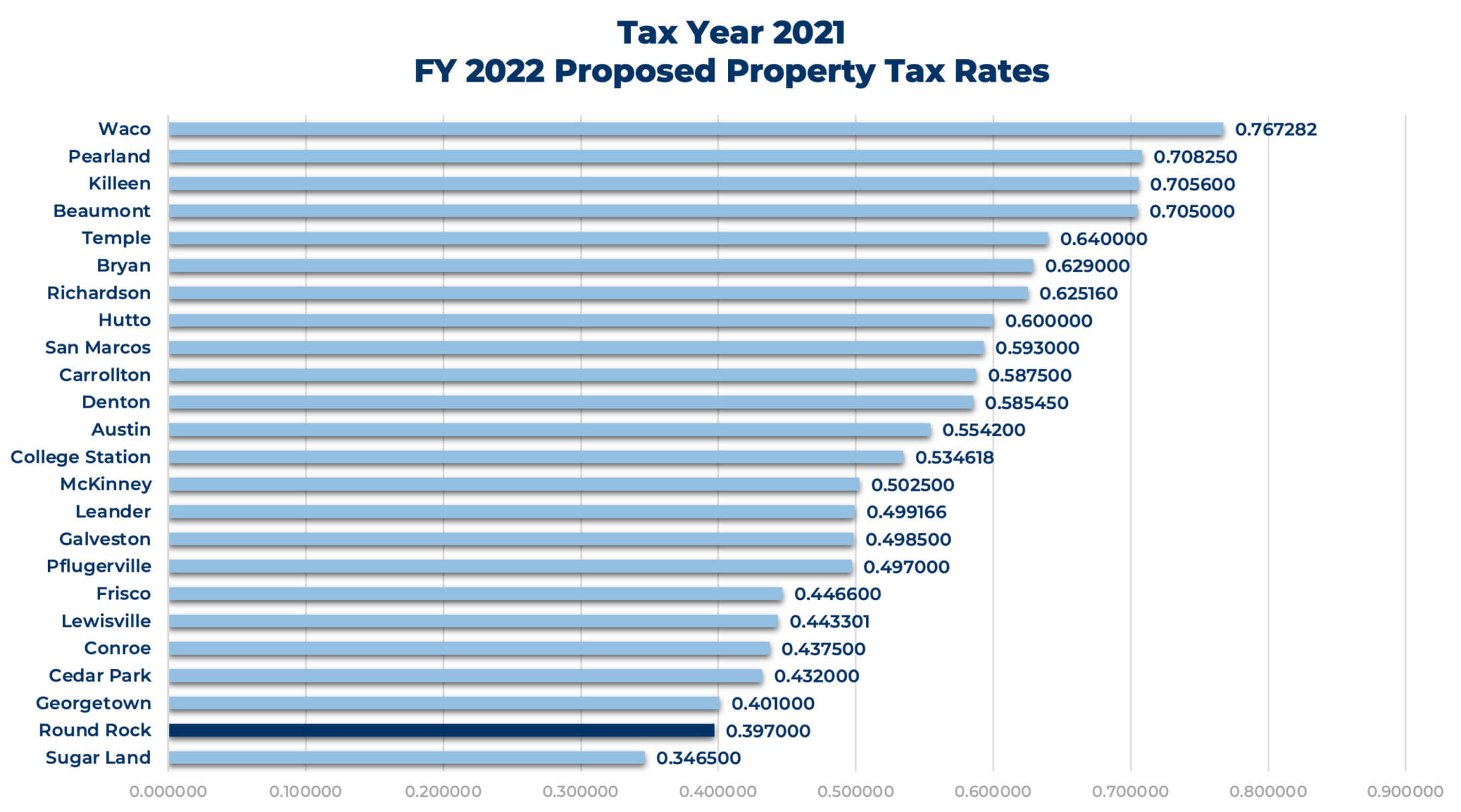

Aggressive Road Building Program Requires Slight Tax Increase City Of Round Rock

Williamson County Proposes Lower Tax Rate Ahead Of Final Budget Vote Aug 31 Community Impact

County Budget Committee Passes New Property Tax Rate 650m Budget News Williamsonherald Com

Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

2021 2022 Tax Information Euless Tx

County Budget Committee Passes New Property Tax Rate 650m Budget News Williamsonherald Com

Funding Project Connect By Capital Metro Capital Metro Austin Public Transit

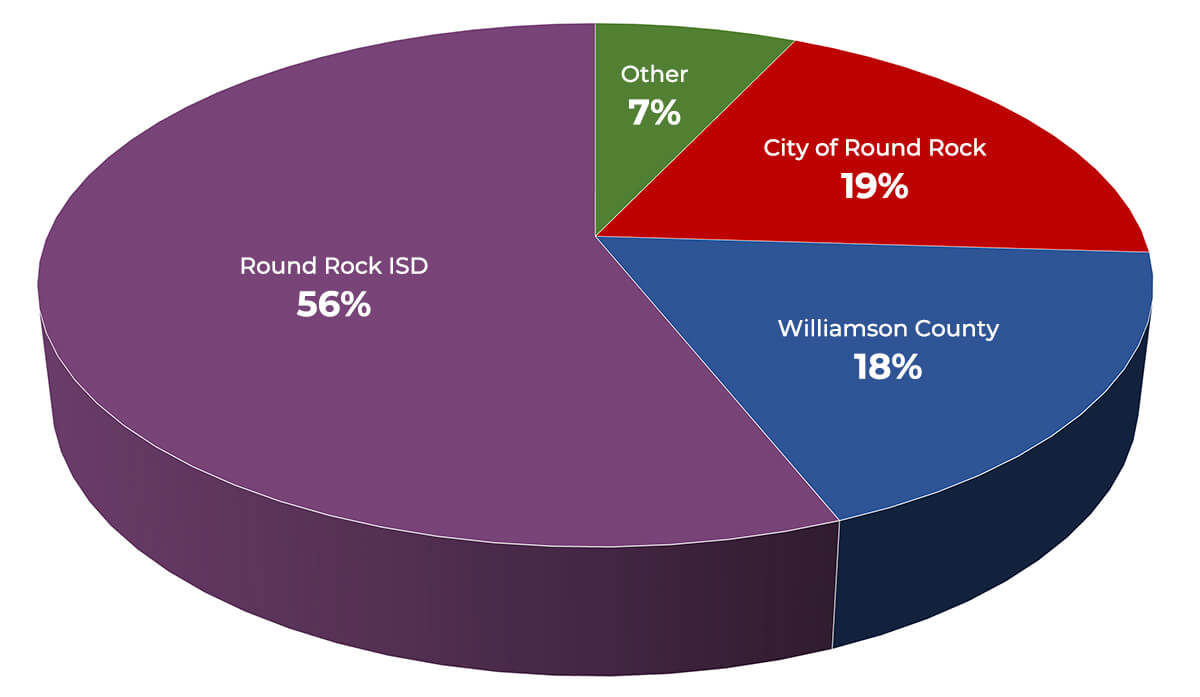

Blog How We Pay For Basic City Services May Surprise You City Of Round Rock

Why Are Texas Property Taxes So High Home Tax Solutions

Letter To The Editor A Word About Relative Taxes Franklin Williamsonherald Com

County Budget Committee Passes New Property Tax Rate 650m Budget News Williamsonherald Com

Pin By Cots On Income Financial Stability Poverty Income

Officials Average Homeowner Expected To See Lower Tax Bill From New Williamson County Budget Tax Rate Community Impact

/cloudfront-us-east-1.images.arcpublishing.com/gray/WWYWMRZ7EVEXHE5PH7EGGB7YCE.PNG)

Post a Comment for "Williamson County Tax Rate"